Introduction

Welcome to the 6th annual “Chicago Home Partner Real Estate Roundup” where we look back at last year’s predictions, and what we experienced in 2016 and give insight into what we’ll see in 2017, especially in IRA aspects. The real estate ira rules do not set a requirement for forcing real estate as an option towards investment, even though the rules of the IRS do allow IRA funds to be used towards a real estate investment. Many people from these areas have hired Property Managers in Jacksonville to help them take care of their real estate and even their worst credit loans to make sure they can avail of it right away. On the other form of investment, Crypto Code System became the most popular designed to make money for you.

Only, before these loans, the government staff should be aware and know about many of the conditions that can connected to the loan just before benefiting from it, read more at What are Online Payday Loans with No Credit Check? 1 exceptional issue concerning the electric age is the application of software which made it possible to have this kind of finances throughout the world and typically for a less risky pace. There may be wonderful computer software developed to obtain the maximum cope like gambling online through https://dreamjackpot.com, so reassure your army monetary counselor provides the necessary technological know-how to present your household with a great offer. Compare these different private loans for bad credit and judge whether this satisfies using your profits. You can document this and put it on sodapdf.com software for safekeeping and ease of editing.

We’ve tried to differentiate our report from others in the market. We’ve tried to make it understandable enough for those casual market observers but also comprehensive, using insight from many industry experts, our own personal observations, and local Chicago market data. If you want more information about real estate or the best marketing tactics for mortgage companies, then visit Vision Property Management, if you are planning on starting your own company.

We’ve also attempted to make this report as local as possible. Since a majority of our clients reside in North Side* neighborhoods, we will focus on these areas when discussing market trends and data.

Boundaries include the following: North – Rogers Park, West – Irving Park/West Loop, and East – Lake Michigan and South – the Loop.

What We Predicted Last Year

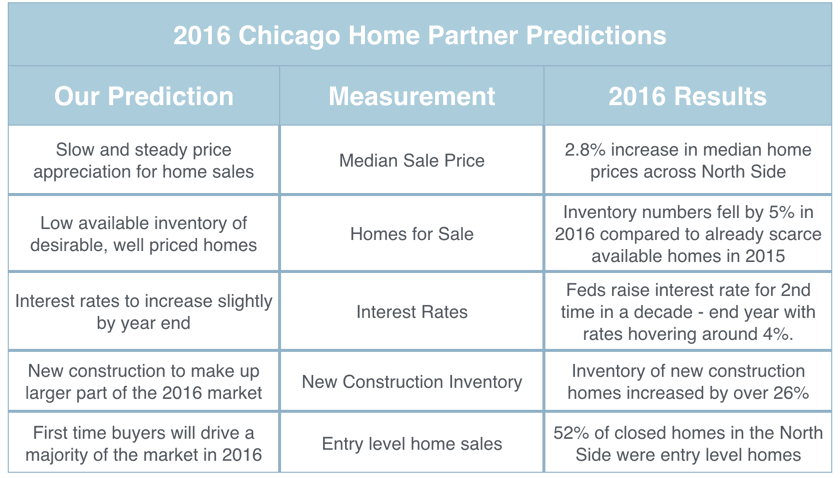

2016 had all the indicators to be another great year in Chicago real estate and at year-end, the numbers show that with the exception of constraints on available housing, it was a banner year for home buyers and sellers alike.

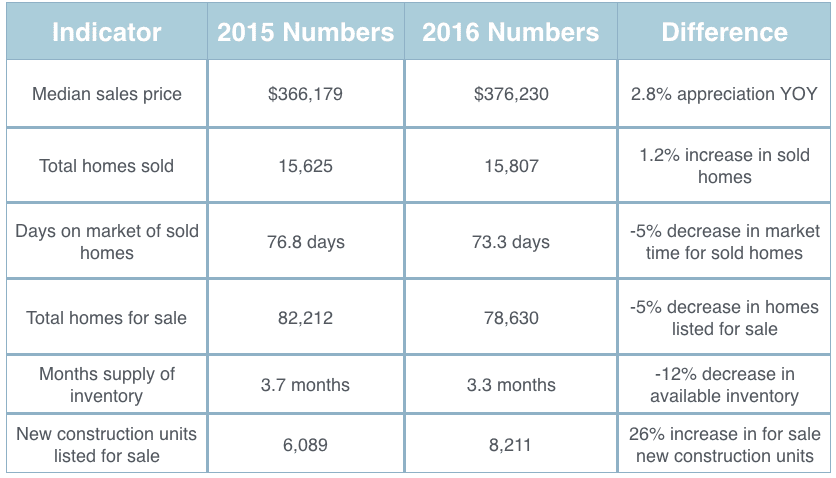

Below are our 2015 market predictions specific to the North Side as well as 2016 year-end numbers. As you can see, we were pretty spot on with the only real surprise coming from the lack of sellers providing housing stock to appease buyers entering the market. Housing supply was in such high demand, the inventory dropped below the already low numbers of 2015. In a related article, take a look at this company that provides, custom countertops seattle was.

All of these numbers point to a very strong and steady housing market for both buyers and sellers alike. However, it’s important to consider emerging trends and outside factors that will have a long-term impact on Chicago's growth rates. Visit www.districtofcolumbialocksmith.com for more information about the latest security housing trends today. In the following sections, we will dive into each of these, discuss them on both a national and local level, as well as share our thoughts on how this will impact the housing market in 2017. In another advertisement, if you are planning to purchase an audio component, check this link home theater systems ashburn va.

2016 North Side Market in Review

Any time we’re asked about the state of the Chicago real estate market, we always take two very interconnected measures into consideration. These pieces, when addressed as a whole, give solid insight into our market.

- Prices – what buyers were willing to pay for homes.

- Inventory – the number of quality/well-priced homes available for sale and the buyer's demand to purchase them.

2016 Home Price Appreciation – Nationally and Locally

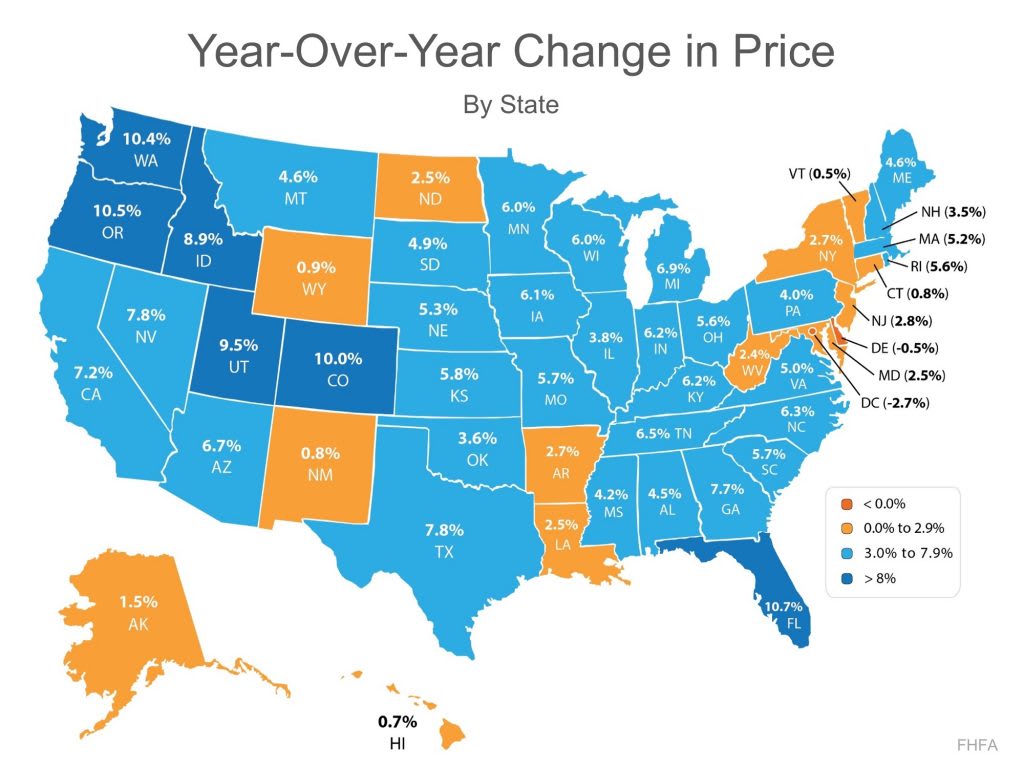

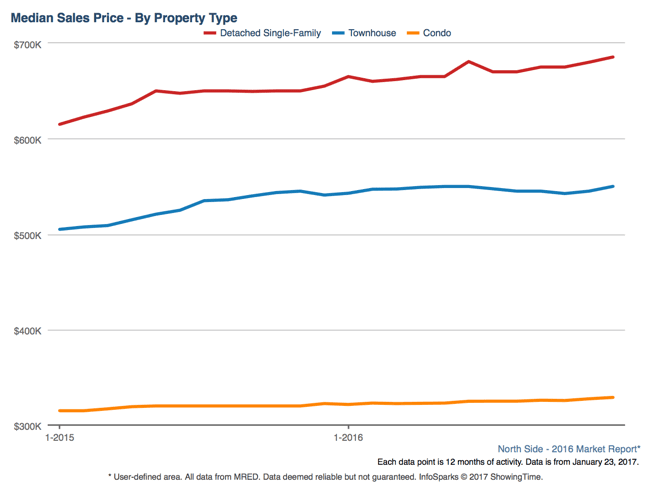

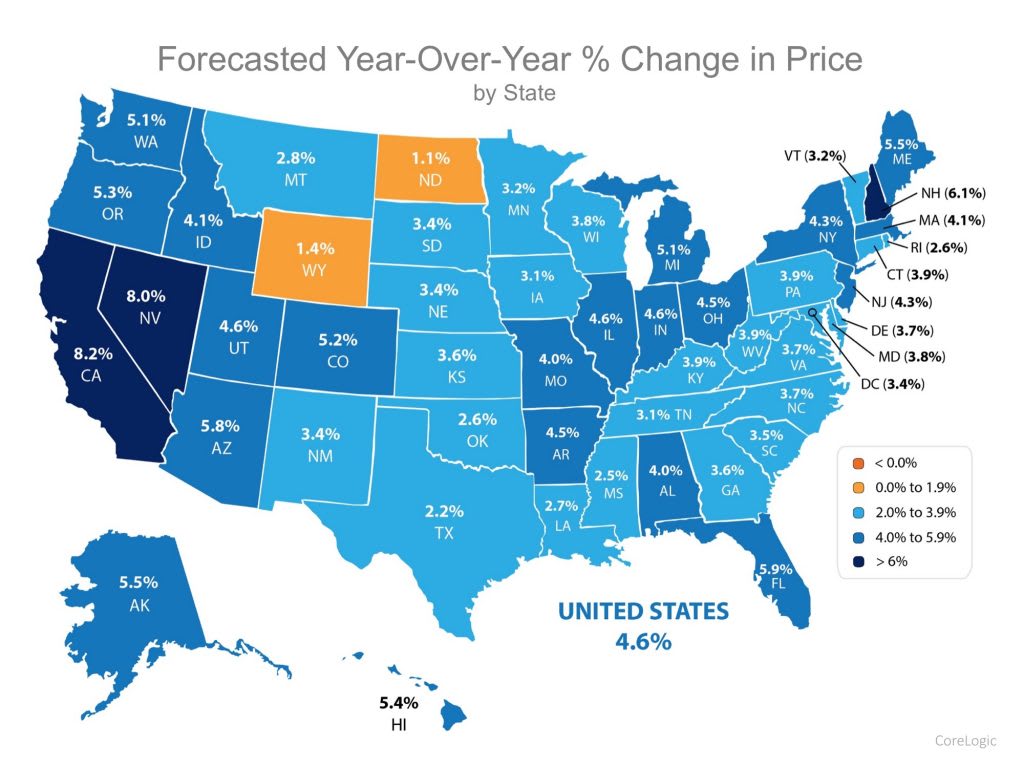

Throughout 2016 and across the nation, the story of pricing remained the same. For the fourth year in a row, median home prices steadily increased, though at a much more moderate level than in previous years. In fact, when taking a look at the nation as a whole, not one state reported a decrease in median home prices.

North Side Market

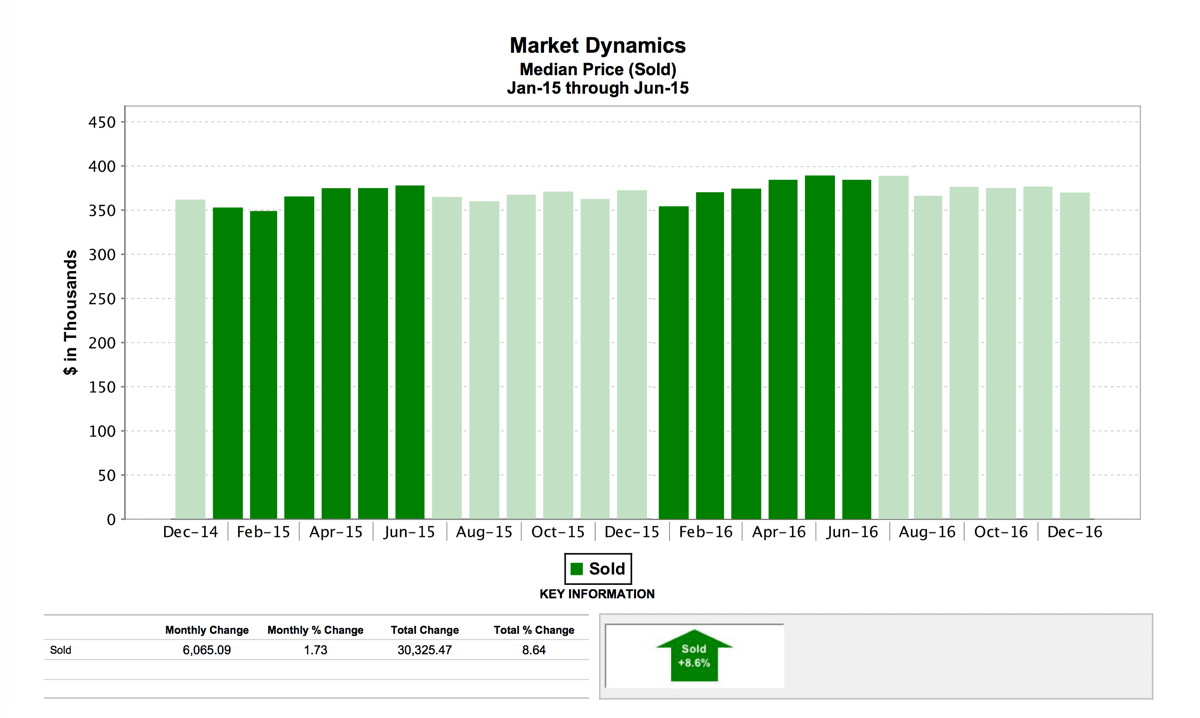

The North Side followed suit with the state as a whole, experiencing a 3% appreciation year over year. The average home sold for $376,230.00 in 2016 versus $366,179.00 in 2015 in roughly the same amount of time, (73 days on average). Distressed properties have all but disappeared in this region of the city, with many of those remaining quickly snatched up by investors or developers before hitting the market.

What was most interesting about the appreciation of the values was the timing during the year in which homes sold. Homes that closed during the 2nd quarter of the year also referred to as the Spring Market sold for nearly 4% higher than the other 3 quarters of the year. Essentially, sellers who entered the market earlier in the year and took advantage of a more sizable buyer pool definitely saw a higher value than those who waited.

2016 Inventory, Supply, Demand, and Overall Activity

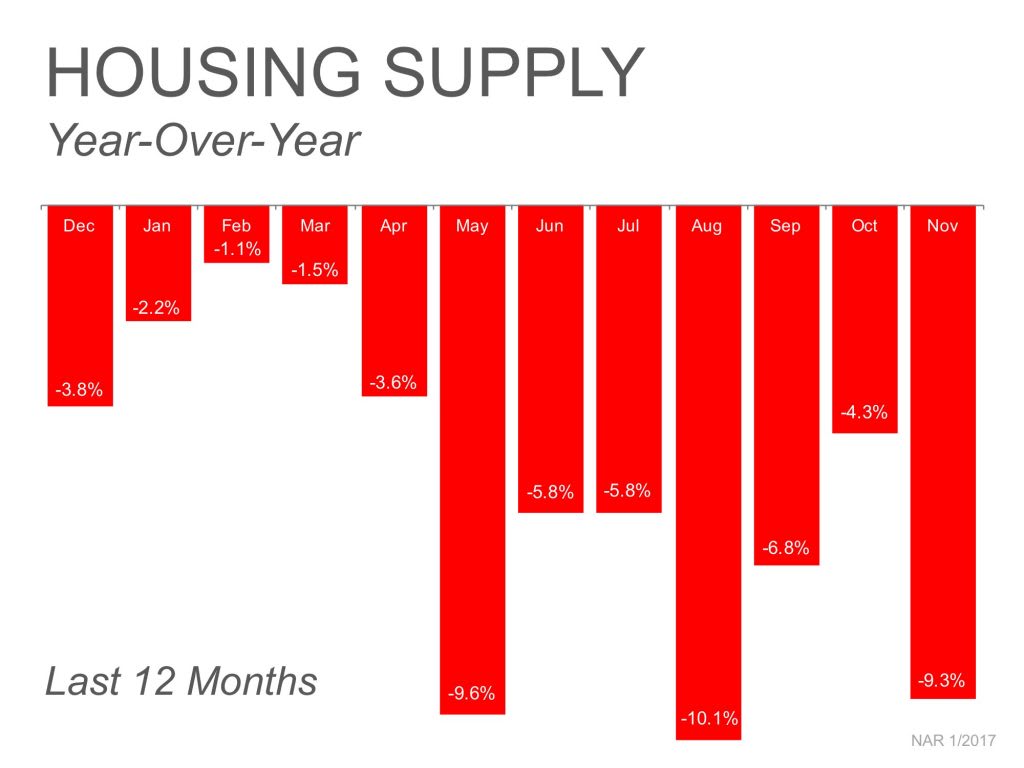

A continued hurdle the Chicago market has faced since the turn-around in late 2012 is the significant lack of available for-sale housing stock. This is far from a “Chicago” problem mind you. None of the 50 states, except for North Dakota and Alaska, possessed strong “Seller Traffic”, where the month’s supply of inventory was higher than 7 months. In fact, nationwide inventory levels of available homes were down every month in 2016.

North Side Market

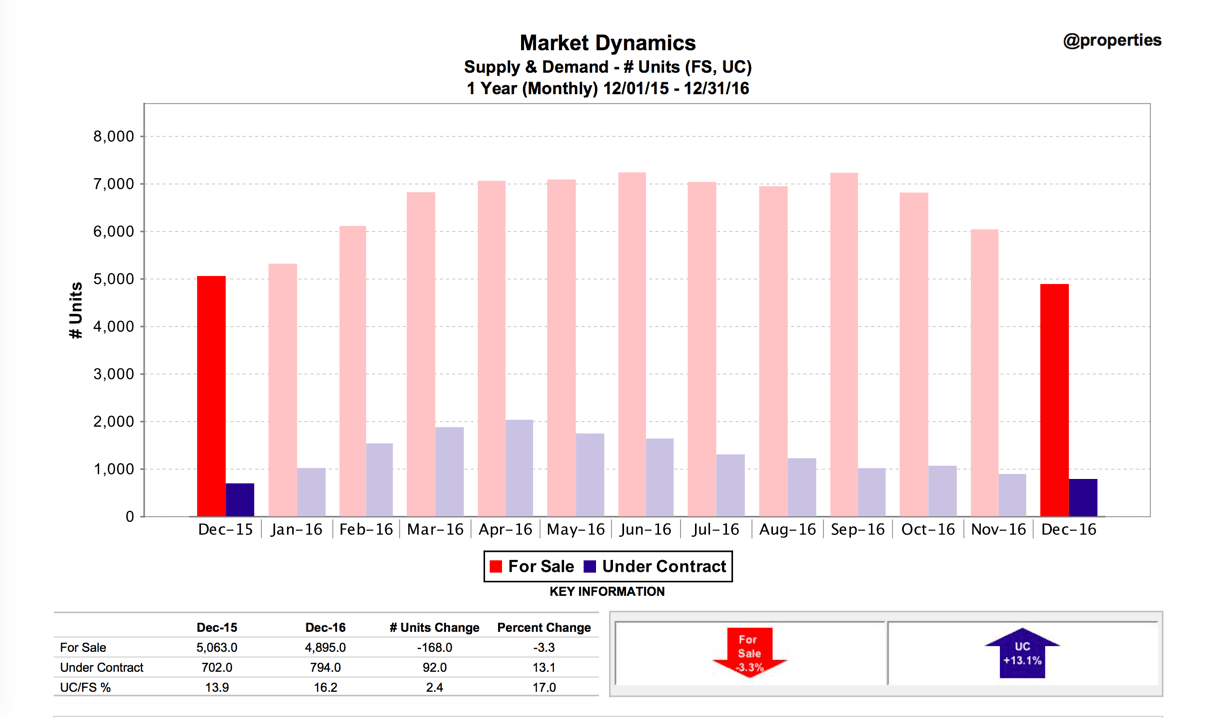

The North Side of Chicago followed the national trends by continuing to post inventory levels below what is considered a “healthy and balanced” market. In fact, the total available homes for sale in 2016 slid even lower than those listed in 2015, averaging 12% lower than the previous year’s inventory.

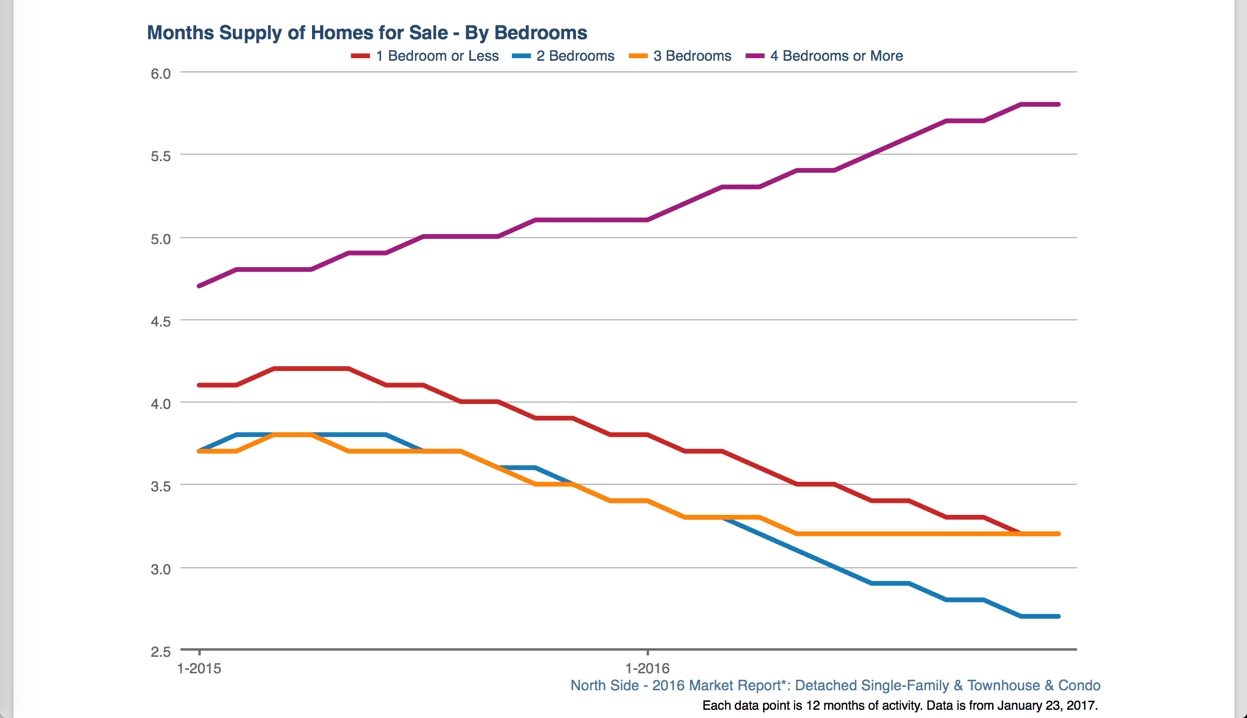

Months supply of inventory, MSI, is calculated by dividing the number of homes available in a given month by the number of homes that have gone under contract for the same month. The result will be the number of months needed to absorb today’s inventory, otherwise known as MSI.

Typically, MSI numbers of a healthy market represent 6 months' supply of inventory. As detailed in the chart below, the MSI in North Side neighborhoods, (regardless of home size), all fell well below healthy levels of a balanced market.

2016 – What We Saw in the Market

It’s easy to say that 2016 followed similar trends as the year prior, but that wouldn’t tell the whole story about what happened and why. Below we’ve charted out some of the year-end numbers that show the differentiation between the two years and provide some insight as to why we believe this happened.

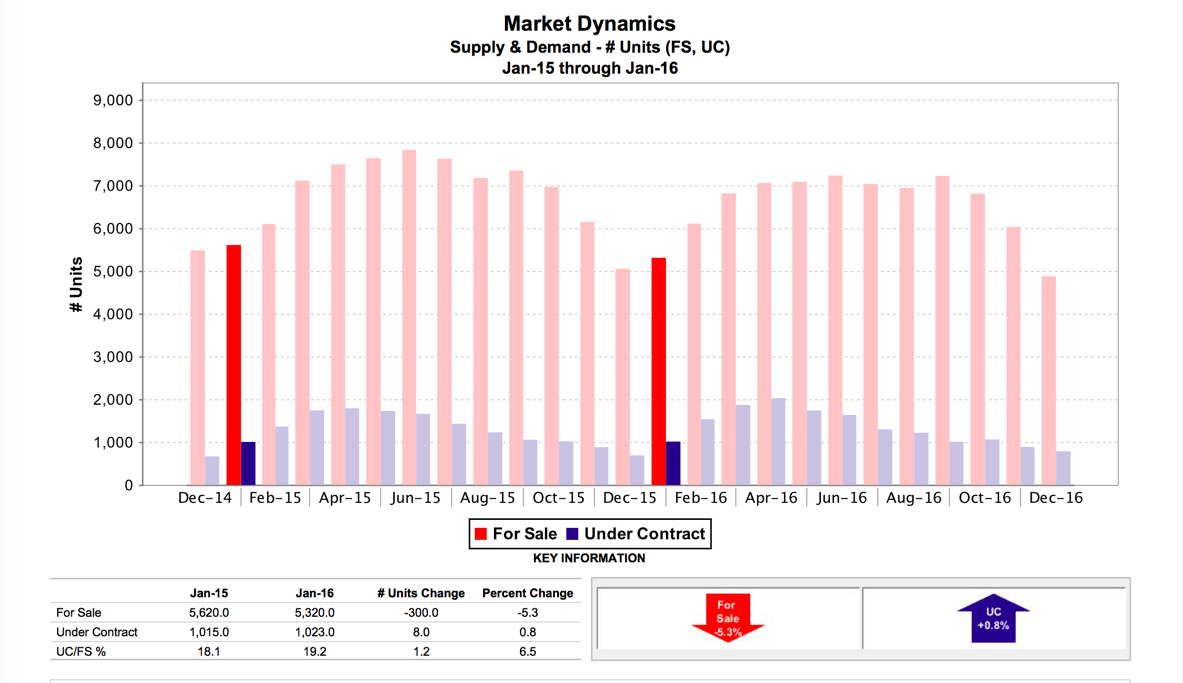

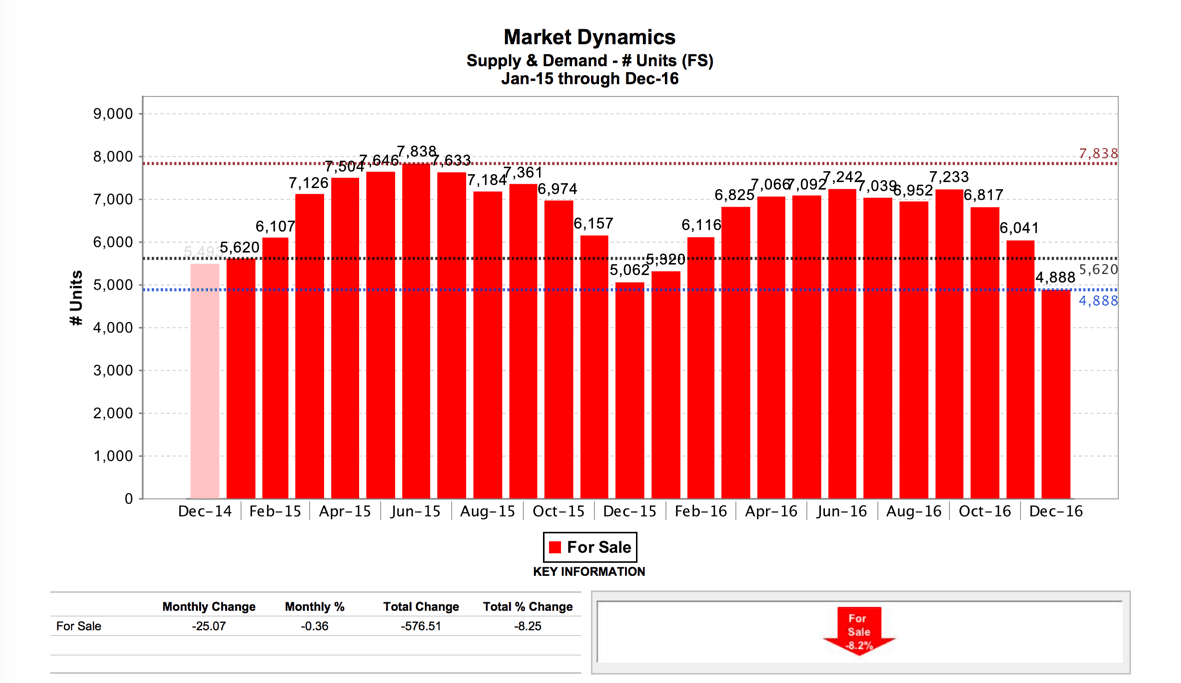

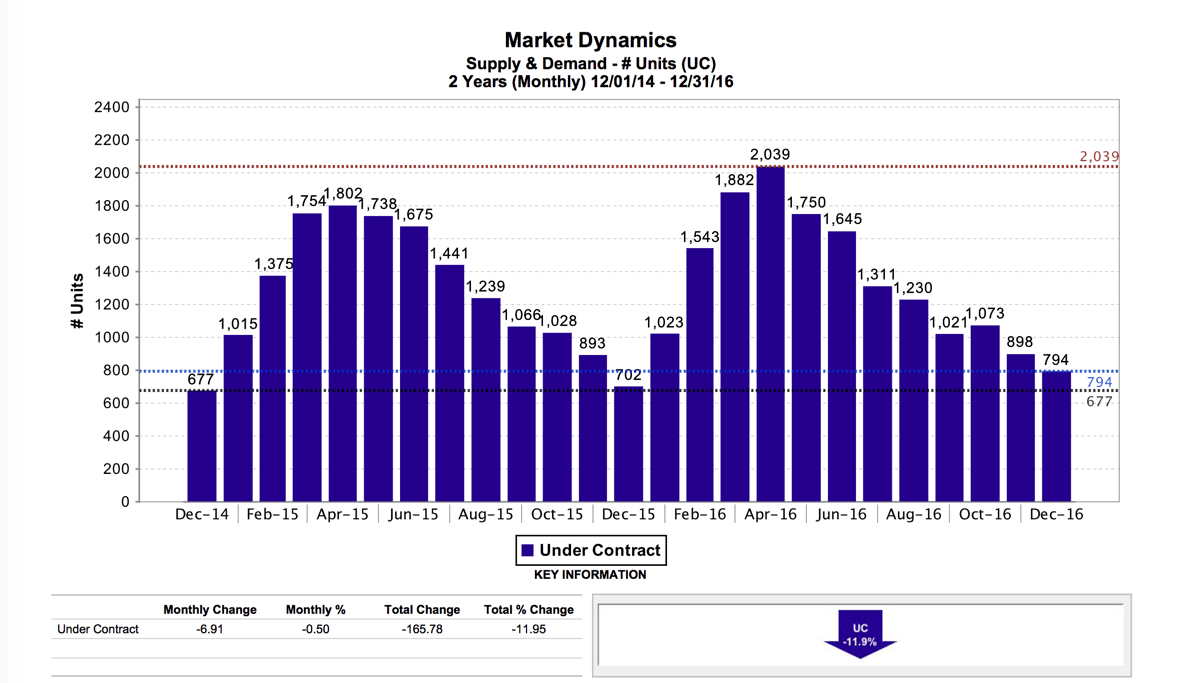

Much like 2015, the 2016 Spring market got a quick start with 1,023 properties under contract in the month of January. This number was right in line with what we saw the year prior with one significant difference. However, the January 2016 inventory of homes for sale was down 5% year-over-year. This doesn’t seem like an incredibly significant number until you realize that a 5% deficit represents over 300 homes that potential buyers did not have the opportunity to evaluate.

As the months went on, this deficiency of inventory continued to fluctuate between 4-7% below the previous year’s numbers. After so many qualified buyers stranded on the sidelines last year and an appreciation in prices, we expected to see an increase of “for sale” properties. However, never once during 2016 did we see inventory numbers equal those of 2015.

Conversely, the number of contracts written surpassed those of the previous year for much of 2016. February saw a 12% increase YOY, (year-over-year) of properties under contract, March saw a 7% increase YOY, April saw a 13% YOY increase, and so on.

Contracts abruptly slowed mid-year, falling below those numbers posted in 2015, typical for any election year. After setting a blistering pace of YOY contract increases in the first half of the year, the market suddenly slowed and fell behind numbers set in 2015. Regardless of which side of the fence you sat on in November, the uncertainty of market reactions to new leadership always disrupts the real estate market.

In summation, 2016 proved to be a year in which inventory remained scarce, buyers continued to create pent-up demand and low interest rates fueled this highly competitive market that we have continued to experience since the recovery began in late 2012.

Other Contributing Market Factors

Where increasing prices, challenging inventory levels, and a market influenced by an election are some of the things we experienced in 2016, it’s important to include the supporting factors that made this all possible.

Mortgages:

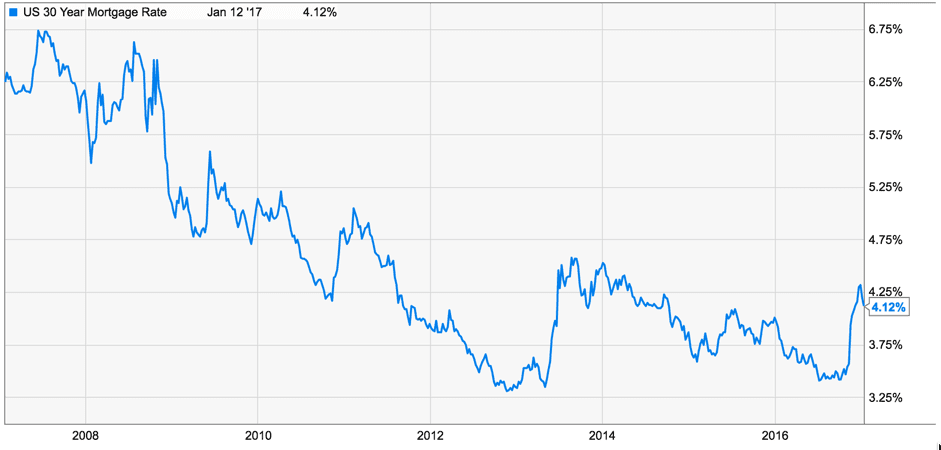

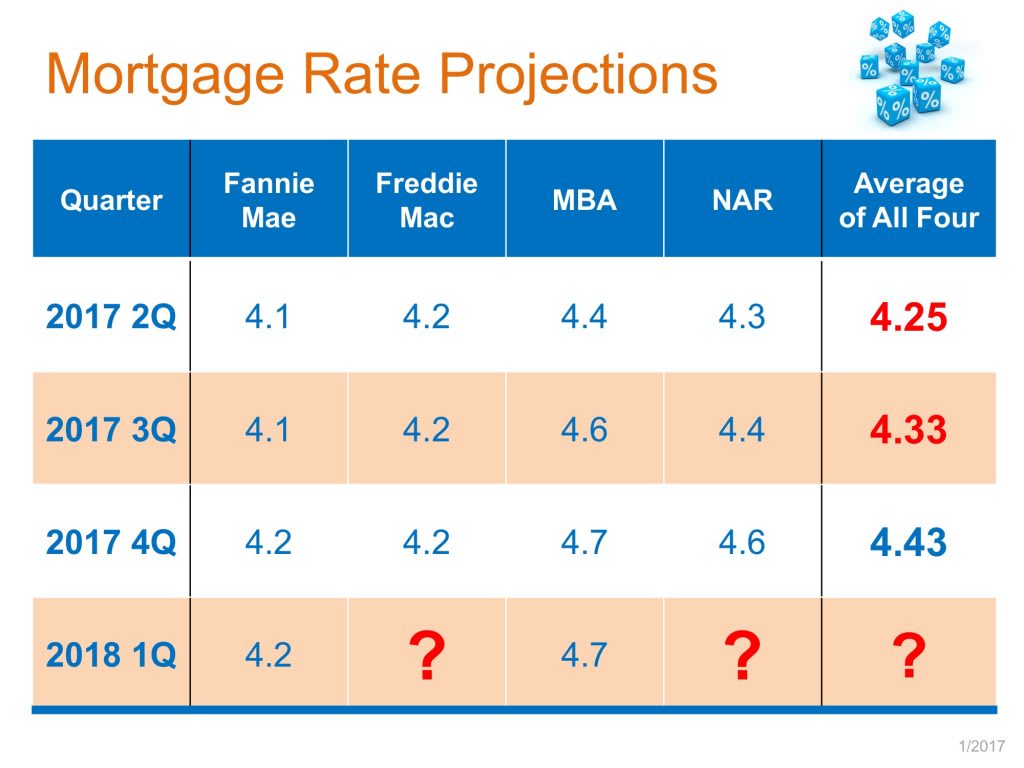

The FED raised interest rates near the end of 2015 and again at the end of 2016, yet for much of the year we witnessed near-record lows which continued to fuel “cheap money” for home buyers, (indicated in the chart below). This increase in the FED, along with uncertainty of new leadership in Washington, led to a significant, although temporary, jump in rates to 4.3%, the highest we’ve seen in over two years. Since then, rates have come down closer to 4.1% but should have little impact on the overall buying power of consumers this Spring market.

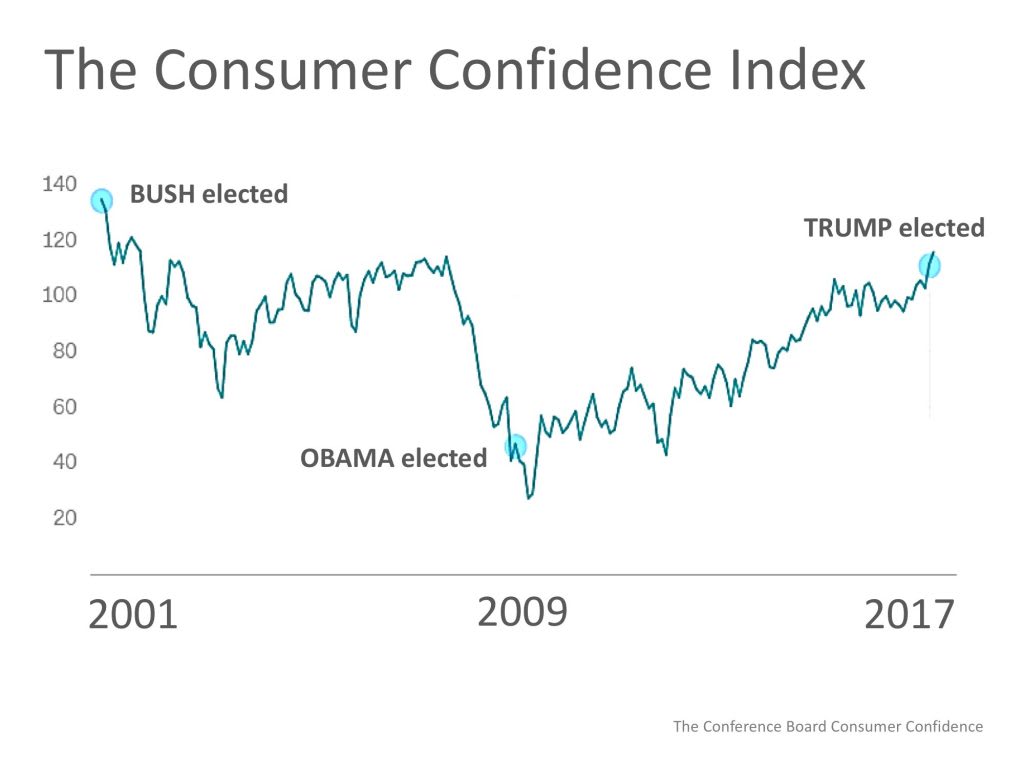

Consumer Confidence:

Low gas prices, employment growth, and a return to work have all helped the latest Consumer Confidence Index numbers continue their positive growth witnessed across much of the Obama administration. After starting the year around 92.6, confidence experienced significant gains to close out the year at a 13-year high of 98.2.

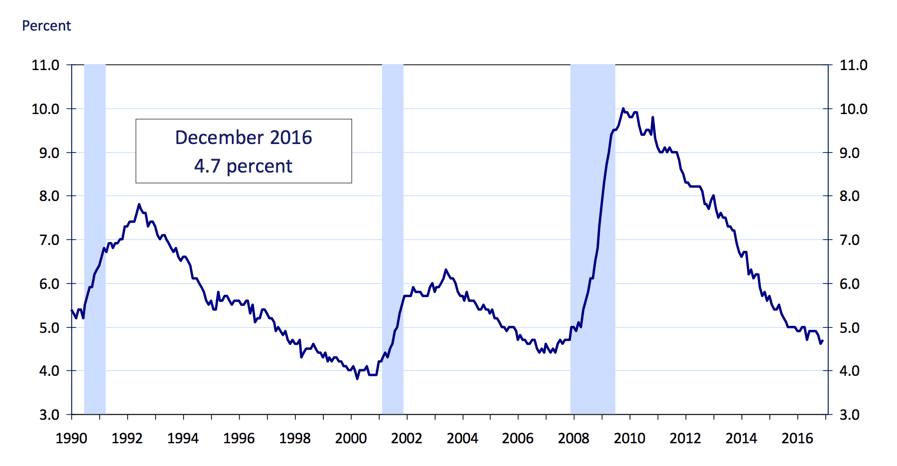

Employment Growth

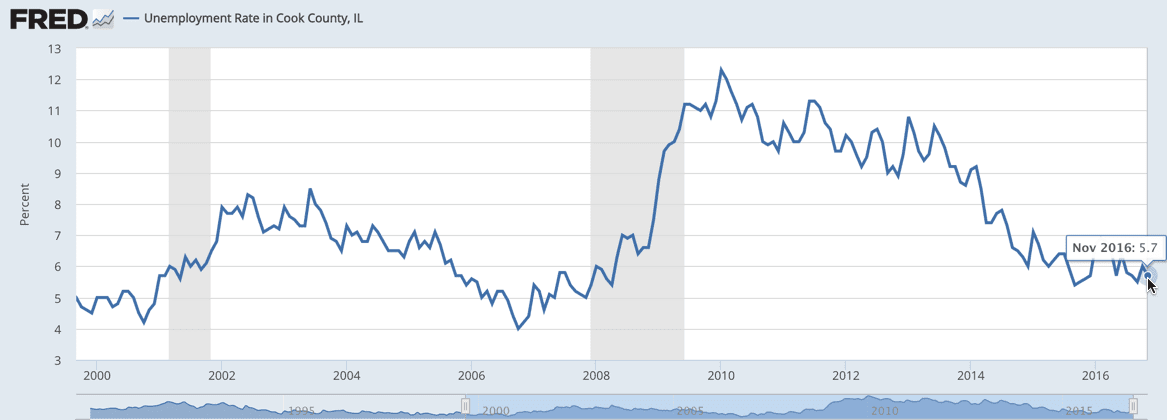

The U.S. economy experienced a steady decline in unemployment numbers from the beginning of the year to close out at 4.7%. This December reporting is extremely significant as it marks unemployment at near 2007 pre-downturn numbers for the first time. This growth in new jobs, career security, and increasing rental rates have helped to motivate younger Americans into home ownership.

Illinois numbers remained positive as well, adding 28,400 more jobs in 2016 and bringing our unemployment rate down to 5.7 percent in December.

First Time Buyers

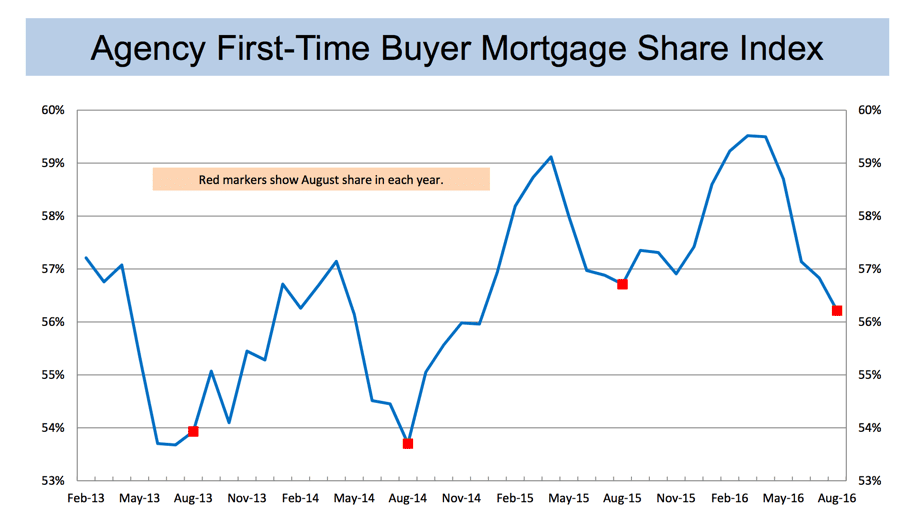

With mortgage rates low, consumer confidence on the rise, and employment numbers continuing to grow, first-time buyers helped drive the market in 2016. First-time home buyers made up nearly 56% of all homes purchased in 2016.

What We Expect to See in 2017

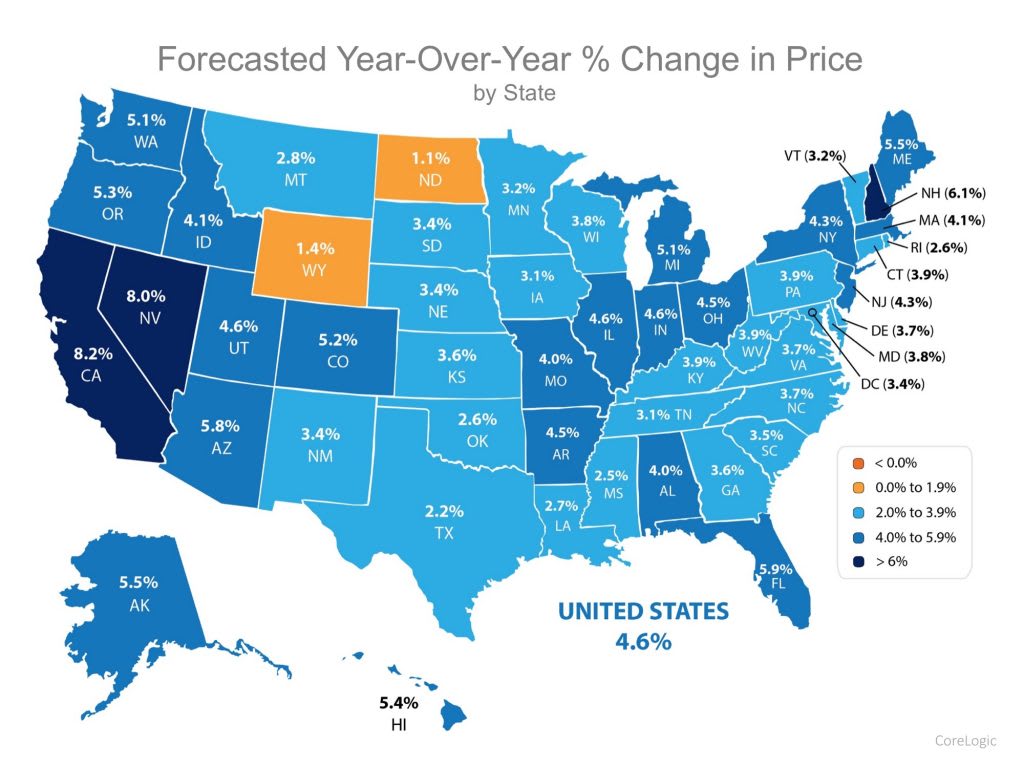

Slow and Steady Price Appreciation

If you pay attention to the media, a recent Tribune article wrote, “Chicago’s 2017 housing market will be weakest in nation…”, stating our growth and appreciation rate is thought to place us near the bottom of the 100 largest metropolitan areas. The article then goes on to say both prices and sales will increase in Chicago, however, they’ll be at a stunted rate compared with these other areas. They expect Chicago metro home prices and sales volume to climb a moderate 2%, much like we experienced in 2016. This falls well below increases projected nationally where home prices are anticipated to climb 3.9 percent and home sales are predicted to rise 2.6 percent.

Many of us who have worked in real estate through the downturn look at this modest growth rate as a positive trend. Many of the cities cited at the top of the list for growth also lead the way in foreclosures, delinquencies, and house depreciation during the downturn. Where slow and steady might not be revered as “sexy” or headlines, it also insulates us from significant downfall. These steady price increases will help the market in a number of different ways:

- More sellers will be able to list their homes.

- Demand for homes will remain high as more consumers are due to affordability.

- Move-up homes will continue to be affordable for expanding households.

Available Housing Inventory to Remain Lean

Much like we predicted in 2016, the story of 2017 will revolve around limited inventory for sale to a growing pool of market-ready homebuyers. There are a number of factors that will contribute to this, but a high level of competition for quality homes in desirable locations is assured. Here are some of our reasons for this prediction

- Many move-up buyers have already sold and purchased near schools, families, or larger homes to accommodate growing families. There’s no real motivator for them to sell.

- Rental rates, low-interest rates, and higher job security will fuel even more young buyers to enter the market, increasing overall demand

- An almost non-existent distressed property market that has made up decent amounts of available inventory in years past.

- Loosening mortgage standards, lowering FICO scores, and required down payment will all bring more buyers into the market.

Financing: Rate Increase (Slightly)

As stated earlier, in late 2016 the FED voted to increase the Fed Funds rate again.

It’s important to stress that mortgage rates don’t necessarily follow the FED funds rate, it can influence rates significantly. As you’ll see in the projections below, all estimate an increase of roughly half a point, which should not have any adverse effects on buyers in the market.

First-time Buyers Will Continue to Drive the Market

As stated before in this report, first-time buyers represented a majority of the owner-occupied sales in 2016 and will continue to do so in 2017. In addition to factors discussed previously incentivizing new buyers into the market is that of loosening mortgage requirements. This subject has essentially been a “taboo” since the real estate meltdown of the late 2000s, yet a new leadership in Washington, an improving economy, and high consumer sentiment have already allowed banks and lenders alike to begin loosening the purse strings.

Most real estate experts have a sense that Mr. Trump’s presidency will result in fewer business regulations, which could ultimately allow lenders to be more liberal with underwriting standards, and allow more nontraditional lenders to enter the market.

This would allow many who have been unable to enter the market due to lack of down payment or low(er) FICO scores to do so. Where This would potentially increase demand for homes and thus, drive appreciation, looking to enter the market, it’s to be noted that this is could bring higher-risk borrowers into the home market.

Millennial Buyers Enter the Market, Maybe.

Homeownership remains cheaper than renting nationally in almost all of the 100 largest metro areas according to a recent report by Zillow. Chicago experienced an increase of 6.2% over 2015 with an average rent rate of $1,956. However, with a record 3,100 rental units delivered in 2016 and another 4,000+ expected in 2017, this number may have hit its cap.

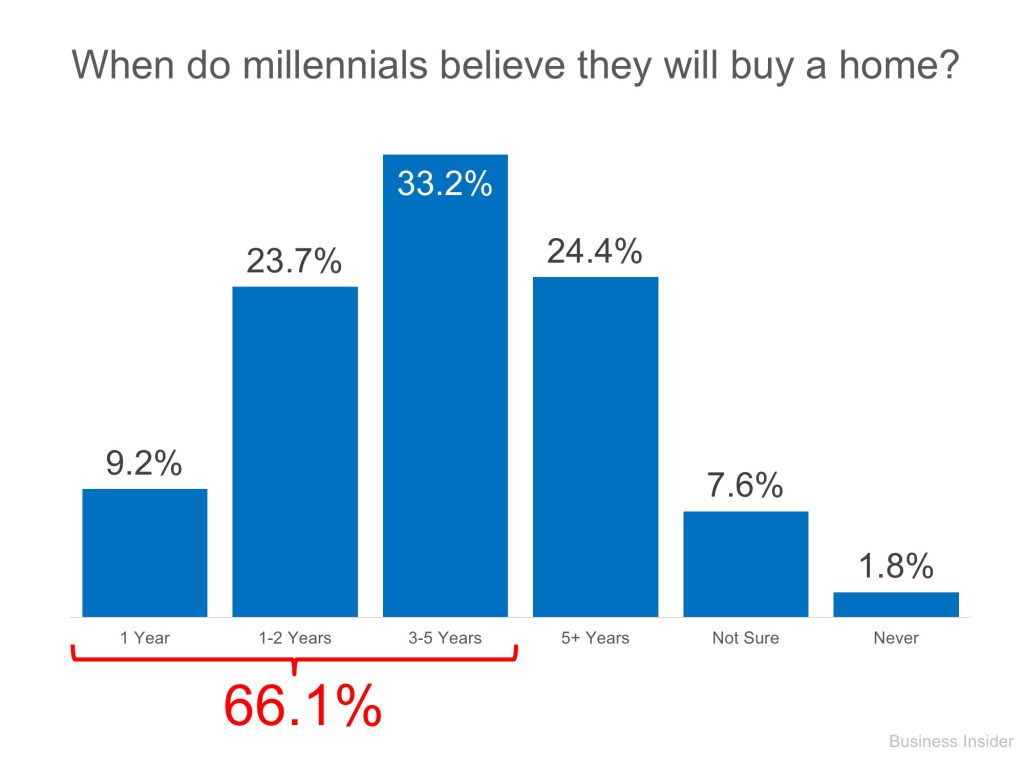

Many millennials, inspired by a positive job market and these increasing rental rates have been toying with the idea of home ownership. According to an article by Business Insider, over 30% of millennials expect to purchase a home in the next 1-2 years and over 60% expect to purchase a home in the next 5. With many new programs geared towards first-time buyers, lowering FICO requirements and down payments, these young buyers made an impact in 2017.

Millennial home buyers have entered the housing market in a big way. As of 2015, Millennials surpassed Baby Boomers as the largest generational group in America, and they now make up the largest group of home buyers. As a new real estate agent, marketing to Millennials should be among your top priorities. You’ll want to begin building marketing campaigns that are specifically targeted toward this powerful group.

Sometimes labeled as “Generation Y,” Millennials are people born between the early 1980s and the early 2000s. They were projected to surpass 75.3 million people as a group in 2015, according to Pew Research Center. With the core group of Millennials between 18 to 34 years old, they are now within the age range where they are most likely to need a place to either lease or purchase. Many of them (or at least those who can afford to do so) are beginning to buy their first homes and invest in real estate for the first time.

How to Connect with Millennial Real Estate Prospects

Millennials love their technology. They grew up with high-tech gadgets, desktop computers, and smart devices. When marketing to Millennials, know that they are more likely to respond to online marketing and communication efforts as opposed to newspaper ads, flyers, and postcards. Although you may have a physical office at your brokerage firm or at home, don’t forget to take advantage of an online virtual office, too. This will allow you to interact with prospective Millennial home buyers online—whether through social media, email, Skype, text alerts, or other means.

Some of the most effective options for targeting Millennial home buyers (and others) are shareable blog posts and short videos posted on YouTube and Vine. Many agents today are writing their own blogs and posting videos from their smartphones on social media sites that can be seen worldwide. As more people “Like” their video tours of home listings or share them on Facebook, Twitter, LinkedIn, Pinterest, Google Plus, Tumblr, or Instagram, the potential growth rate of viewers is almost limitless.

Tech-savvy Millennials also tend to have very short attention spans. The famous AICDC (Attention, Interest, Conviction, Desire, and Close) sales technique—first developed by the Dale Carnegie Professional Sales Course several decades ago—still applies when marketing to Millennials. Try using the following AICDC sales strategy on Millennial real estate prospects, keeping in mind that the very first step may be the most important.

- Attention: First, you must grab or capture your prospect’s attention as quickly as possible.

- Interest: Once you’ve sparked their attention, kindle their interest by asking them lots of probing questions to uncover their primary needs and interests before offering them solutions.

- Conviction: Next, gain the customer’s conviction, or strongly favorable opinions, by offering them evidence supporting beneficial claims, such as testimonials from past clients or exceptional housing price comps.

- Desire: Then continue fueling the client’s “fire” (or desire) by showing them solid housing data numbers, inspiring videos, or beautiful open houses that support your claims.

- Close: A high percentage of sales professionals are hesitant to ask for the close from the customer. But if you don’t ask, then the client can’t give you a very favorable “Yes” response after showing their significant interest, desire, and conviction in the product or service that you’re offering.

Home Buyers and Sellers in 2017

At Chicago Home Partner, we believe that each of you has different reasons for potentially entering the housing market in the coming year.

Maybe 2017 is the year for you to become a homeowner?

Maybe it’s time to quit being a landlord and sell that home you’ve been holding onto.

Maybe your needs have changed and you need a new home to better suit them.

Regardless of the situation, we are always here to help and advise you as to the BEST decision to help you achieve your goals. That being said, here are some overarching suggestions everyone entering the market should consider and discuss.

Sellers

As noted above, the 2016 numbers show that to our surprise, the available inventory in North Side neighborhoods was actually lower than it was during 2015. However, this lower inventory was coupled with a higher number of contracts signed when comparing year-over-year numbers. This relationship of lower supply and greater demand is similar to what we experienced between 2014 and 2015.

With this, it gives us great confidence in our expectations for the coming year. More importantly, what does this mean to sellers? Well, in layman’s terms, buyers are still seriously shopping the market, which doesn’t have the necessary supply to support that demand. Because of this, homes should sell relatively quickly and at strong prices as contracts written year-over-year increased in December 2016.

Now, as at the beginning of any year, (and any new presidential term for that matter), there are still a few question marks that could come into play throughout the coming months. However, the data shows that the markets should remain strong for sellers in 2017.

Where we cannot in good faith tell everyone reading this that now is the time to sell your home, it’s a great idea to start discussions sooner rather than later if you’re considering doing something in 2017. Contact us and we can provide you with an accurate assessment of your local market and current comparable properties.

Buyers

Planning is the key to success in any market, but even more importantly in markets that have less inventory and stronger buyer demand. What this means is that buyers looking to purchase in 2017 should begin assessing their current situation ASAP. Conversations with your real estate advisor early in the process can be beneficial in making sure that you are positioning yourself to have success in a competitive market. As we always tell our clients, we would prefer to have an excess of time in our real estate endeavors versus not enough.

As stated in our predictions, we do believe that home prices will continue their steady appreciation through the year, fueled by buyer demand and limited inventory. Especially if you are looking to buy in a highly desirable location, school district, or building, it’s important to have finances in order, search criteria narrowed down, and be ready to pull the trigger as inventory becomes available. In fact, over the last two years, prices have gone up from January to June by 8.6%.

That being said, rising interest rates and economic changes could help to slightly soften some of the appreciation in certain areas and certain property types, property owners, and the management industry. It is our belief that when comparing the past few years of strong seller’s markets, 2017 should show more balance between the buyers and sellers, which will be music to many buyers’ ears. For more information, visit FloridaPropertyManagement (FPM).

In Conclusion

Buying or selling a home is much more than a financial decision – it’s an emotional and personal one regarding your future, where you will raise your family (2 and 4-legged) and what life changes you may be facing. We at Chicago Home Partner understand ALL the factors that come into play when making this decision and are here to advise regardless of the outcome. In addition, local locksmith near me aim to provide the best and most efficient service possible without it costing you a fortune.

Please, feel free to reach out to us with any questions this report may have inspired or for more granular information on what your neighborhood is currently experiencing.

Amanda McMillan, Tiffany Vondran, and Jared Nell.